(Previous Topic: Configuring Sales Data)

Setting Up Taxes

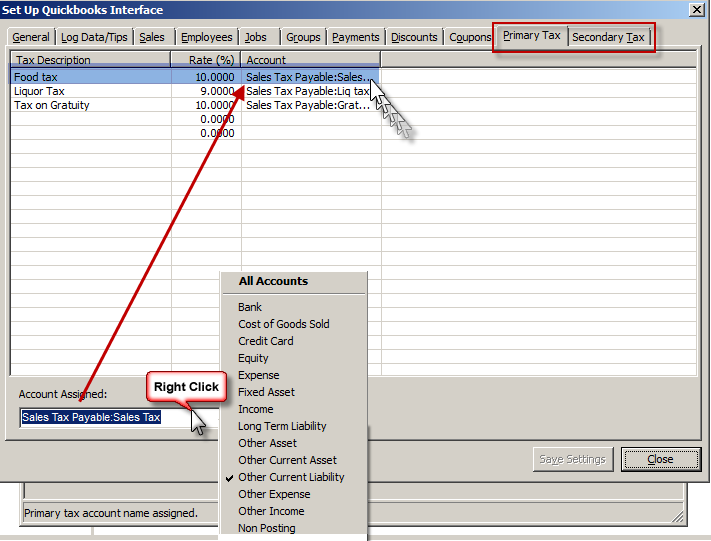

Since the set-up operation of both the Primary Tax is the same as with the Secondary Tax, the description below should apply to both except when otherwise specified.

These tax tabs provides for the assignment of the different sales tax withheld types for recording into the QuickBooks. Taxes being liabilities of the restaurant to the IRS will be most likely assigned accounts of Other Current Liability type.

As with previous tabs in the Set-Up dialog, the accounts that may be assigned to each tax type could be the same or different.

While assigning the same account provides for simplicity, assigning different accounts (probably as subsidiary of major accounts or sub-accounts) provides more detail specially when looking at QuickBooks related reports (i.e. Balance Sheet, Statement of Cash Flows)

The Account Assigned function by default displays all accounts available in QuickBooks. However, this function can be configured to display certain account types by right clicking on the field and choosing a specific account type (i.e. Other Current Liability). This is convenient when configuring multiple data fields within the same programming session (typically occurs with initial installation).

To change a tax type account assignment:

- Click on the tax type to be changed.

- Right-click on the Account Assigned and select Other Current Liabilities.

- Click again and select the proper account to assign.

- Review the changes.

- If satisfied, click on the Save Settings button.

Note: In the BackOffice, you can set the primary and secondary tax tables in Set-Up->General->Tax Tables. For more information on setting up tax tables refer to the documentation. Refer to the QuickBooks reference manual for more information on setting up accounts.